Investing in property is once again in the spotlight, with more investors showing interest in the local market. This is due to low vacancy rates, rising rents, strong yields, increasing prices, and a more stable interest rate environment. While some investors look further afield and interstate to find the right investment opportunities, many opportunities can be found closer to home that deliver strong capital growth and high rental returns.

With the resurgence in investor activity, we have taken an in-depth look at which suburbs in the Sutherland Shire are giving investors the best returns. Find out how each suburb compares and identify key areas of opportunity for future investments. To make it easier to measure, we have focussed on two key metrics: rental yield and capital growth. For new or first-time investors, rental yield refers to the annual return or income investors receive from their investment property. It is represented as a percentage of the property’s overall total value.

For example, if a property is worth $1,500,000 and weekly rent is $1,500, the annual rent received is $1,500 x 52 = $78,000. Therefore, the rental yield is $78,000 divided by $1,500,000 x 100 = 5.2%

As a general rule, the higher the yield, the better the overall return.

Capital growth, expressed as a percentage of the property’s total value, refers to the increase in the property’s total market value. For example, if a property was worth $1.5 million on 1 January 2023 and $1.65 million on 1 January 2024, then it experienced 10% capital growth.

Whilst previous capital growth doesn’t necessarily reflect future growth, it gives insight into a given suburb’s demand vs supply relationship. Savvy investors will also consider infrastructure developments, planning changes and population forecasts of an area when ascertaining suburbs with potential growth opportunities.

Top performing suburbs in the Sutherland Shire (apartment rental yields)

As a rule of thumb, apartments tend to produce higher yields than houses despite the latter’s higher capital growth. A higher rental yield means more cash flow, which can provide a more immediate return from the investment.

This is consistent across the Sutherland Shire, with all bar three suburbs with apartments returning a yield of 4% or higher for investors, with Kirrawee, Sutherland, Jannali, Miranda and Sylvania Waters all returning 4.4% or above. The highest recorded yield for houses was 3.70%.

Top performing suburbs in the Sutherland Shire for rental yields (houses)

When looking at houses, Yarrawarrah currently delivers the best yield for investors at 3.7%, followed closely by Barden Ridge and interestingly, Bundeena.

Top suburbs for capital growth

Over the past 5 years, largely due to the pandemic boom, we have seen significant price rises across Sydney, with most property owners experiencing strong capital growth. Whilst apartments tend to deliver higher rental yields, houses have provided better capital growth than apartments.

For example, houses in Cronulla have increased in value by 42% on average over the past five years versus 18% for apartments. In Sutherland, houses have experienced a growth of 55% compared to 15% for apartments. Looking ahead, we expect this trend to balance out and swing in favour of apartments, with price growth in the apartment market expected to outpace houses in the coming years.

Best Sutherland Shire suburbs for capital growth (houses)

The top 5 performing suburbs within The Shire included a mixture of prestige waterfront properties and smaller lifestyle suburbs within 35 minutes of the CBD via car or train.

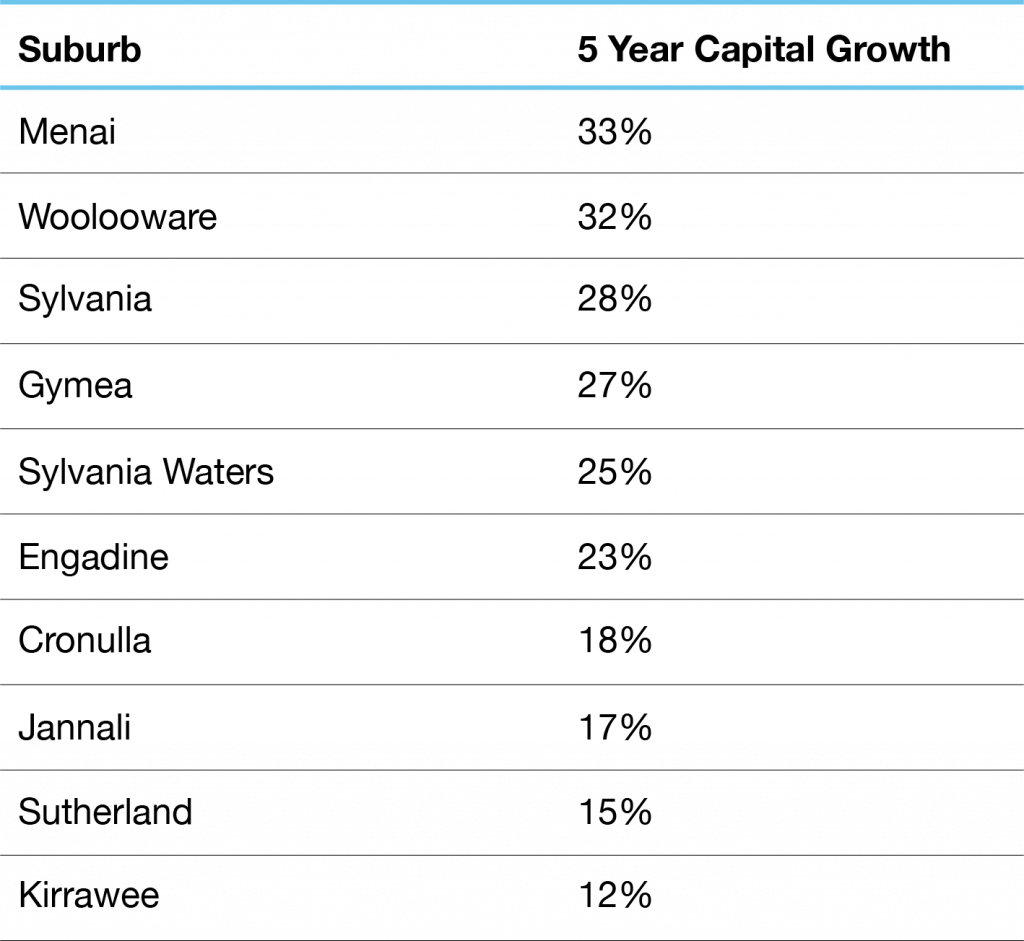

Best Sutherland Shire suburbs for capital growth (apartments)

In terms of apartments, the top performing suburbs included a few surprises, with Menai coming out on top, ahead of suburbs like Woolooware and Gymea, which have traditionally been favoured by investors.

Key Takeaways

The property market is always a hot topic, with many experts having an opinion on the dos and don’ts of property investing. Looking at the facts, investors who have held properties over the past five years in the Sutherland Shire have experienced significant capital gains, with houses outperforming apartments. Whilst we see the pendulum swinging and favouring apartments over the coming years with unit price growth expected to outpace houses, long-term, owning a house as an investment property will likely always provide a higher level of capital growth.

Apartment growth will likely be fuelled in coming years by increased investor interest, with downsizers also looking to relocate to lower maintenance properties. Whether you are looking for a house or apartment as an investment, look for suburbs with access to facilities, lifestyle attributes and strong demand from professionals and families, which can help drive property values upward over time.

Looking at the data, 80% of the top performing suburbs are within close proximity to transport, whilst the other 20% are primarily comprised of larger properties with a stronger demand from families. The key is to focus on making the best choice using the facts at hand whilst equally considering your budget. Depending on your overall investment strategy, looking to balance capital growth and rental yield can be an excellent place to start. The growth will give you a return and the yield will help manage the ongoing costs of holding your investment property.

For investors looking at apartments in the local area, Sutherland and Jannali could provide good opportunities in the coming years. Both suburb centres are due, if not already started, some regeneration, which is likely to bring in new employment opportunities and upgrades to infrastructure. Both have excellent public transport options and are within 35 minutes of the CBD, 20 minutes from Cronulla’s beaches, and provide easy South Coast access. Future supply will also be limited, which could, in turn, drive prices upward unless further zoning changes come into effect and open up new opportunities for multi-storey developments.

In terms of houses, larger properties with 3-4 bedrooms have been increasingly popular with tenants over the past 2-3 years due to changes in how we live and work. Areas with lower median prices, such as Engadine, Loftus, Gymea and Kirrawee, may provide good capital growth whilst maintaining reasonable rental yields.

If you are interested in learning more about investing in the Sutherland Shire or would like to discuss an existing investment property in further detail, please contact our Business Portfolio Manager, Emma Bull, at 0414 798 435 or [email protected]. Alternatively, please fill out the form below, and we will contact you.

Thank you for your enquiry. A member of our team will be in contact with you shortly.